Texas title loan companies offer swift financial aid using vehicles as collateral, with flexible terms and faster approval compared to traditional loans. Ideal for urgent needs and those without strong credit history, these short-term Car Title Loans have defined repayment periods ranging from weeks to months. Timely repayments avoid penalties, and regulations protect both parties while providing debt consolidation options for long-term stability.

In times of financial crisis, understanding emergency cash options is crucial. Texas title loan companies offer a unique solution for those in need of swift funding. This article delves into the world of these lenders, exploring how they facilitate emergency cash advances and the associated repayment regulations. By understanding the dynamics between Texas title loan companies and borrowers, individuals can make informed decisions during financial distress, ensuring a clearer path to recovery.

- Understanding Texas Title Loan Companies

- Exploring Emergency Cash Options

- Navigating Repayment and Regulations

Understanding Texas Title Loan Companies

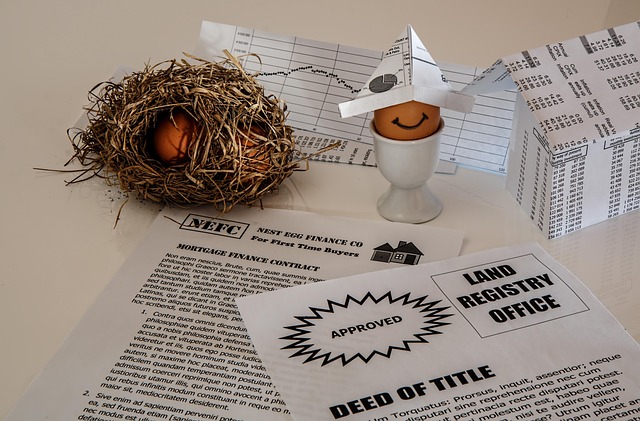

Texas title loan companies offer a unique financial service designed to provide emergency cash solutions quickly. These businesses specialize in lending money using a vehicle, typically an automobile, as collateral. The process involves a simple application, where borrowers present their vehicle for inspection and evaluation. This appraisal ensures the vehicle’s value aligns with the loan amount offered.

One of the key benefits is the flexibility they offer. Borrowers can often negotiate terms, including repayment plans that fit their financial capabilities. Unlike traditional loans, these companies focus on the vehicle as security, making the approval process faster for those in urgent need of cash. The use of a car as collateral also means borrowers can retain their daily transportation while accessing much-needed funds during emergencies.

Exploring Emergency Cash Options

When facing unexpected financial emergencies, many Texans turn to Texas title loan companies for quick cash solutions. Exploring emergency cash options is a wise step, especially when traditional banking routes might not be immediately accessible or suitable. These companies offer Car Title Loans as a viable alternative, allowing individuals to tap into the equity of their vehicles for immediate funds. The process typically involves a simple application, requiring your vehicle’s title as collateral, and you can receive your loan in a matter of hours.

This option is particularly beneficial for those with limited or no credit history, as Texas title loan companies often operate without performing extensive credit checks. Their primary focus is on the value of your vehicle rather than your credit score. Loan Terms can vary, providing flexibility to borrowers who may need more time to repay. This accessibility has made Car Title Loans a preferred choice for many Texans in need of rapid financial assistance during emergencies.

Navigating Repayment and Regulations

When dealing with Texas title loan companies, understanding repayment terms is crucial. These loans are typically designed for short-term financial needs and come with specific Loan Terms. Borrowers should be prepared to repay the loan within a specified period, often ranging from several weeks to a few months. The process begins with Loan Approval, followed by structured repayments that align with their income schedules. Many Texas title loan companies offer flexible repayment plans to accommodate borrowers’ unique financial situations.

Regulations play a significant role in protecting both lenders and borrowers. These rules dictate how much interest and fees can be charged on the loan, ensuring fair practices. Borrowers should familiarize themselves with these regulations to avoid deceptive lending practices and ensure they are not burdened by excessive debt. Repaying on time is essential to steer clear of penalties and maintain a positive financial standing, considering options like Debt Consolidation if long-term financial stability becomes a priority.

When faced with a financial emergency, Texas title loan companies offer a viable option for quick cash. By understanding these lenders, exploring various emergency cash options, and navigating repayment regulations, individuals can make informed decisions to suit their unique circumstances. Remember, while Texas title loans can provide a short-term solution, it’s crucial to explore all alternatives and prioritize long-term financial stability.