Texas title loan companies operate under strict regulations protecting consumers with clear terms for short-term, high-interest loans secured by vehicle titles. Key features include small loan amounts, shorter repayment periods, and transparent fee structures. Borrowers enjoy flexibility with early repayment options and the ability to extend terms. These measures ensure fairness, particularly for individuals with bad credit, providing accessible yet responsible financial solutions in cities like San Antonio and Houston.

In the state of Texas, understanding the legal rights when using title loan companies is crucial for consumers. With the rise in the number of Texas title loan companies, it’s essential to be aware of regulations governing these transactions. This article delves into key aspects like Texas title loan regulations, consumer rights and protections, as well as repayment options and potential legal consequences. By understanding these factors, borrowers can make informed decisions and avoid pitfalls associated with these loans.

- Understanding Texas Title Loan Regulations

- Consumer Rights and Protections

- Repayment Options and Legal Consequences

Understanding Texas Title Loan Regulations

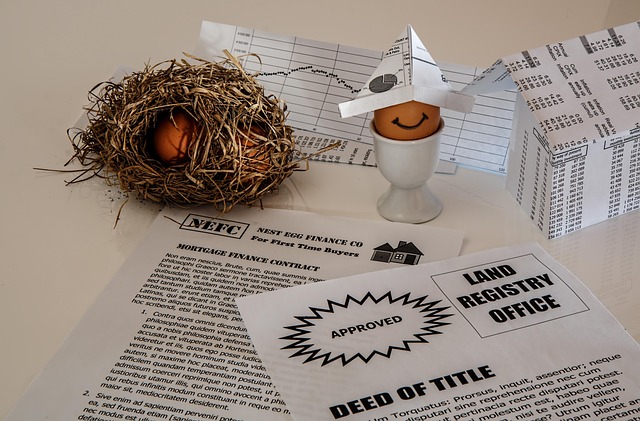

Texas has specific regulations governing Texas title loan companies to ensure consumer protection. These rules are in place to safeguard borrowers from predatory lending practices and provide clarity on the terms and conditions of such loans. When availing of a Texas title loan, understanding these regulations is crucial. The state allows for short-term, high-interest loans secured by a vehicle’s title, offering a quick cash solution for those in need.

The key aspect to grasp here is that these loans are typically for smaller amounts and have relatively shorter repayment periods. Additionally, Texas law provides guidelines on loan terms, including interest rates, fees, and the maximum loan amount. Moreover, borrowers are entitled to certain rights, such as the ability to pay off the loan early without penalties and the option to extend the loan term under specific conditions. For instance, San Antonio loans, like any other in Texas, may offer flexible repayment plans, making it easier for borrowers to manage their finances while repaying the title loan.

Consumer Rights and Protections

When dealing with Texas title loan companies, consumers are protected by various rights and regulations designed to safeguard their interests. These protections are crucial for individuals seeking quick funding through alternative lending methods, especially those with bad credit who might feel limited in their options. The state of Texas has implemented measures to ensure transparency and fairness in the lending process, empowering borrowers to make informed decisions.

One significant right is the ability to understand the terms and conditions of the loan clearly. Texas title loan companies are required to disclose all fees, interest rates, and repayment schedules upfront, allowing consumers to compare offers and choose the best option for their financial needs. Additionally, borrowers have the right to repay the loan in full or refinance it without penalties, providing flexibility and control over their debt. These protections ensure that individuals can access quick funding while maintaining a level of security and understanding of their obligations.

Repayment Options and Legal Consequences

When it comes to repaying a Texas title loan, borrowers have several options available, each with its own implications. The most common approach is structured repayment plans offered by most Houston title loans providers. These plans typically involve equal monthly installments over a set period, allowing borrowers to pay back the loan in manageable chunks. Repayment can also be accelerated if the borrower decides to pay off the entire balance early, which can significantly reduce interest charges.

Defaulting on a Texas title loan comes with severe legal consequences. Lenders have the right to repossess the secured asset—in this case, the vehicle—and sell it to recover the outstanding debt. Failure to repay may also result in additional fees and penalties, further complicating the borrower’s financial situation. Understanding these repercussions is crucial when considering a loan, especially for those seeking financial assistance through Houston title loans. Opting for loan refinancing could be another strategy, but it’s essential to carefully review the terms and conditions to avoid perpetuating a cycle of debt.

When utilizing Texas title loan companies, understanding your legal rights is crucial. This article has provided insights into the state’s regulations, consumer protections, and repayment options, empowering borrowers to make informed decisions. Remember that knowing your rights can help navigate the complexities of these loans, ensuring a fair and transparent process. Always review the terms and conditions carefully before agreeing to any Texas title loan agreement.