Customer experiences with Texas title loan companies vary widely, offering both benefits like quick cash access and drawbacks such as high interest rates. Positive reviews highlight convenience and flexible terms, while negative ones caution against stringent requirements and transparency concerns. Understanding these diverse views is crucial for prospective borrowers making informed decisions within the Texas title loan companies landscape. Thorough research is essential to ensure favorable outcomes for financial health.

“Texas title loan companies have gained prominence as a financial solution for many, but what do real customers say? This article delves into the customer experiences and reviews surrounding these firms. We explore the diverse perspectives and key insights from those who have availed of these services, shedding light on the current landscape of Texas title loan providers. By understanding customer feedback, we can gauge the impact and reputation these companies hold in the state.”

- Exploring Texas Title Loan Companies: Customer Experiences

- Key Insights from Customer Reviews of Title Loans in Texas

- Understanding the Impact and Reputation of Texas Title Loan Firms

Exploring Texas Title Loan Companies: Customer Experiences

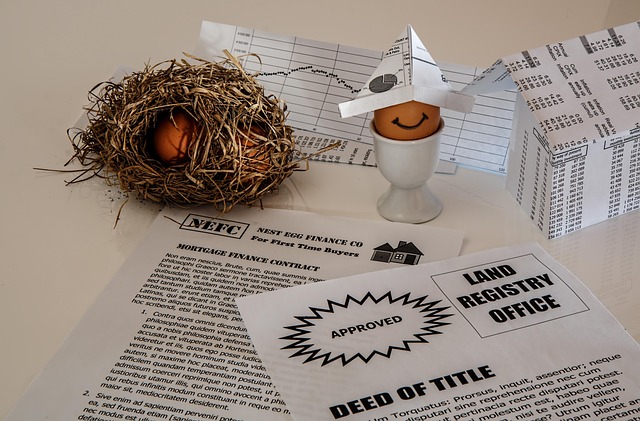

When exploring Texas title loan companies, customer experiences play a pivotal role in shaping public perception and reliability. Many individuals turn to these services for financial assistance, often when traditional banking options are limited or not accessible. Reviews from satisfied customers highlight the benefits of quick cash access, flexible repayment terms, and straightforward processes, making Texas title loan companies a preferred choice for those needing immediate funds.

Negative reviews, however, shed light on potential pitfalls, such as high-interest rates and stringent requirements, especially when it comes to bad credit loans or motorcycle title loans in Houston. Some customers express concerns about the security and transparency of transactions, emphasizing the need for regulation and fair lending practices within this industry. Understanding these diverse experiences is crucial for prospective borrowers, as it allows them to make informed decisions while navigating the landscape of Texas title loan companies.

Key Insights from Customer Reviews of Title Loans in Texas

Customer reviews offer a wealth of insights into Texas title loan companies. By scouring through online feedback from past borrowers, several key trends and sentiments emerge. Many customers appreciate the speed and convenience of Car Title Loans in Texas when facing unexpected Emergency Funds needs. The ability to secure funds quickly using their vehicle’s title as collateral is often highlighted as a significant advantage.

Moreover, reviews also indicate varying experiences with payment plans. Some clients praise flexible repayment options, while others express concern about potentially high-interest rates and the overall cost of borrowing. These insights underscore the importance of thorough research and understanding the terms and conditions before availing services from Texas title loan companies to ensure a positive experience.

Understanding the Impact and Reputation of Texas Title Loan Firms

Texas title loan companies play a significant role in providing financial assistance to individuals facing urgent cash needs. These firms offer a unique service by using the value of an individual’s vehicle as collateral for a short-term, high-value loan. Understanding their impact on the market is essential, especially for those considering a bad credit loan. With quick approval processes, these companies cater to those in need of rapid financial solutions.

The reputation of Texas title loan firms varies widely, and it’s crucial for borrowers to be aware of both the advantages and potential drawbacks. A positive reputation indicates reliable service, fair interest rates, and transparent business practices. Conversely, negative reviews may signal predatory lending, hidden fees, or unfair treatment. Borrowers should carefully research these companies, focusing on quick approval while ensuring they understand the terms and conditions to make informed decisions regarding their financial well-being.

Texas title loan companies have a significant impact on the financial well-being of many residents. By examining customer reviews and insights, it’s clear that these businesses play a dual role: providing quick access to funds for those in need and earning a reputation that ranges from helpful to controversial. Understanding both the positive and negative experiences is crucial when navigating this alternative lending sector. As consumers continue to seek flexible financing options, Texas title loan companies will remain an integral part of the financial landscape, with their success measured not only by profits but also by the satisfaction and safety of their customers.