Customer reviews and experiences are vital for understanding Texas title loan companies, offering insights into reliability, transparency, and flexibility. These loans provide quick cash but require careful management to avoid debt cycles. Weighing benefits like flexible payments against potential drawbacks, such as high interest rates, is crucial. A thorough review of terms and conditions ensures a positive borrowing experience among the many Texas title loan options available.

In the competitive landscape of financial services, understanding customer experiences is paramount, especially within the niche of Texas title loan companies. This article delves into the world of these lenders, exploring customer reviews and insights to uncover both the benefits and drawbacks. By navigating the pros and cons, borrowers in Texas can make informed decisions, ensuring they find suitable and reliable title loan options tailored to their needs.

- Exploring Texas Title Loan Companies: Customer Experiences

- Uncovering Pros and Cons of These Lenders

- Navigating Options: Insights for Borrowers in Texas

Exploring Texas Title Loan Companies: Customer Experiences

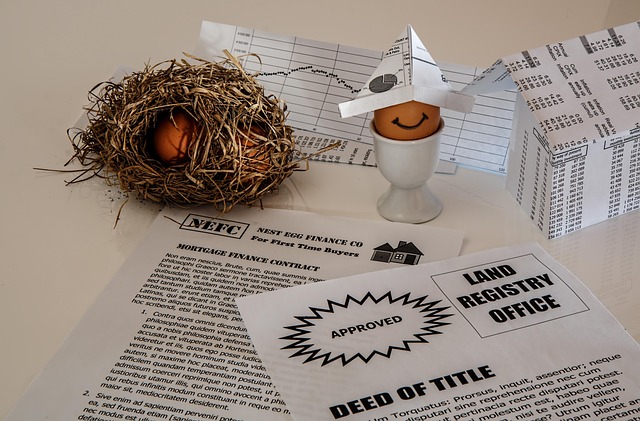

When exploring Texas title loan companies, one of the most valuable resources for potential borrowers are customer experiences and reviews. These insights provide a window into the reliability, transparency, and flexibility of different lending institutions. Many Texas residents turn to title loans for quick cash, especially when facing unexpected expenses or financial emergencies. Customer reviews highlight the ease of application processes, with many praising the convenience and speed of securing funds through their vehicles’ titles.

Moreover, these reviews often delve into the repayment options and payment plans offered by various Texas title loan companies. Terms such as Boat Title Loans and flexible Repayment Options are frequently mentioned, indicating a growing interest in understanding how these loans work. Customers share their satisfaction or concerns about interest rates, terms of repayment, and customer service, offering crucial insights for those considering this type of financing. These real-life experiences help borrowers make informed decisions, ensuring they choose a company that aligns with their needs and provides a positive lending journey.

Uncovering Pros and Cons of These Lenders

When exploring Texas title loan companies, understanding the pros and cons is crucial for borrowers seeking quick financial relief. These lenders offer unique advantages that can be particularly appealing to individuals with limited options. One significant benefit is the flexibility they provide in terms of flexible payments. Borrowers often appreciate the ability to structure repayments according to their income cycles, making it easier to manage debt. Additionally, many Texas title loan companies operate without conducting a thorough no credit check process, which can be advantageous for those with poor or no credit history. This accessibility is one of the primary draws for borrowers in urgent need of funds.

However, there are potential drawbacks to consider. Interest rates and fees associated with these loans can be substantial, leading some borrowers into a cycle of debt. The short-term nature of such loans also means that unless repaid promptly, borrowers may face significant financial strain. Despite the loan approval process being relatively lenient, it’s essential for borrowers to thoroughly understand the terms and conditions to avoid unfavorable outcomes.

Navigating Options: Insights for Borrowers in Texas

Navigating the world of Texas title loan companies can be a complex task for borrowers seeking financial assistance. With numerous options available, understanding the market and choosing the right lender is essential to ensure a smooth borrowing experience. One key factor to consider is the reputation and reviews of these companies. Customer insights provide valuable information about lenders’ reliability, transparency, and the overall customer service they offer.

By reading reviews, borrowers can gain awareness of various aspects, including interest rates, loan terms, and the ease of the application process. Some Texas title loan companies stand out for their same-day funding options, while others might focus on flexible loan refinancing. Borrowers should weigh these factors based on their financial needs and urgency. This informed decision-making process empowers individuals to secure the necessary financial assistance while avoiding potential pitfalls associated with less reputable lenders.

When it comes to Texas title loan companies, understanding customer experiences and insights is crucial for borrowers navigating this unique lending option. By exploring both the pros and cons, individuals can make informed decisions about their financial needs. With a clear view of the available options, borrowers in Texas can confidently choose lenders that best suit their circumstances, ensuring a positive borrowing experience.